Budget Reports

Duties and Responsibilities

Michigan State Law designates the duties of a township treausrer, although township boards may require additional responsibilities or delegate certain duties.

Some of the duties and responsibilities of the Comstock Township Treasurer include:

- Must appoint a deputy

- Must post a surety bond and tax collection surety bond

- Collects real and personal property taxes for township as well as other tax-levying entities

- Collects delinquent personal property taxes

- Responsible for jeopardy assessments in collecting personal property tax

- Collects mobile home specific tax

- Keeps and account of township receipts (revenues) and expenditures

- Prepares some financial reports, including cash activity by fund and bank account (at least monthly) and investment reports (at least quarterly)

- Issues all township checks/payments

- Receives and deposits all township revenues and payments in approved depositories

- Able to designate others to receive and receipt for all monies coming into the township

- Invest township funds in approved investment vehicles as directed by the township board in investment policy and depository resolution

- Township “department head” for tax collecting and other receipt of funds (budgeting and preparation of equipment, software, training, internal staffing, etc.)

- Maintain records of treasurer’s office

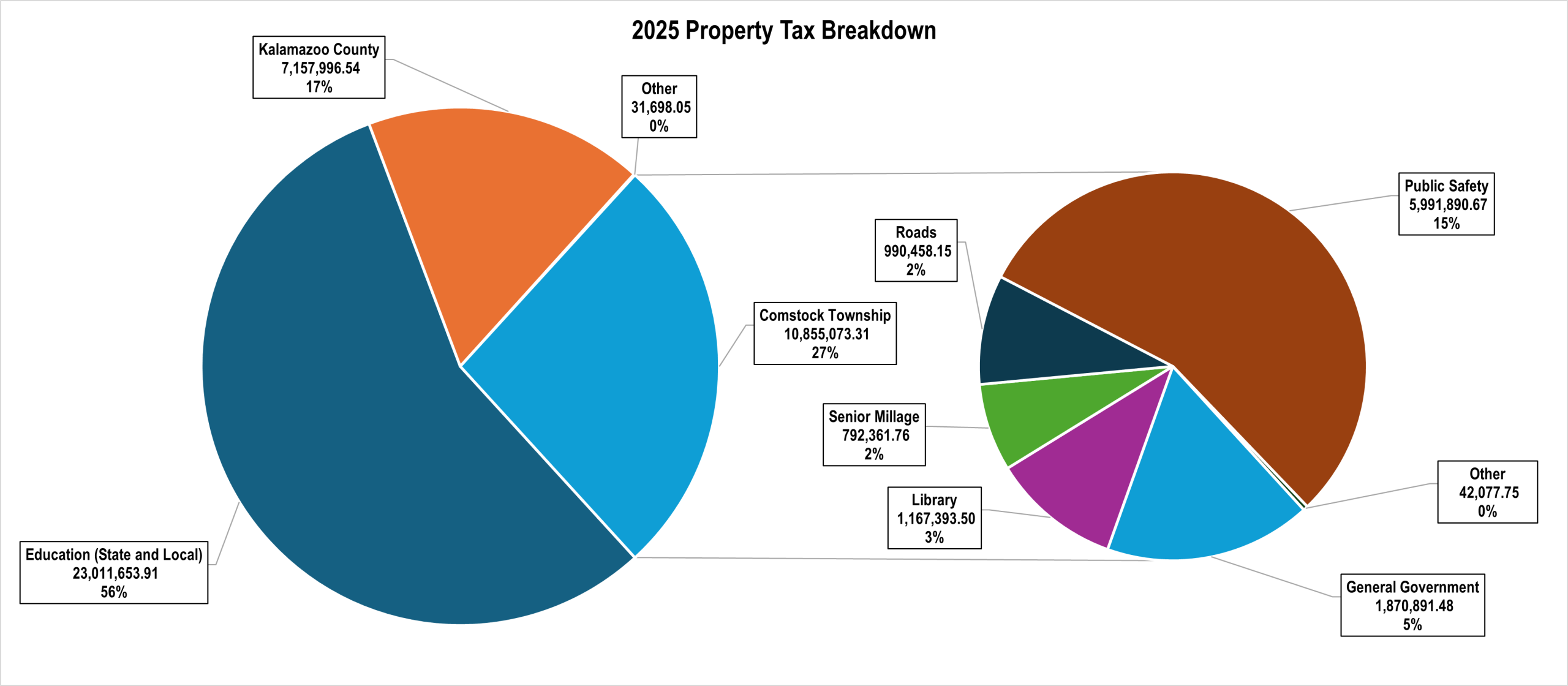

Where do your tax dollars go?

See below for a breakdown of property tax disbursements for the 2024 tax year.